- 3 February 2017

- Michael McGrath

2016 was a tumultuous year on all accounts. With political uncertainty arising from Brexit and the unexpected results of the US election, along with economic uncertainty as China imposed tighter restrictions on foreign investments, it is unsurprising that 2016 saw a 20% year on year drop in global deal values.

Here we provide a brief summary compiled from recent Merger Market reports, detailing current mergers and acquisitions trends, hot sectors and the outlook for 2017.

We’ll then provide some insight around what that might mean for M&A deals in Australia and how it affects your business over the coming year.

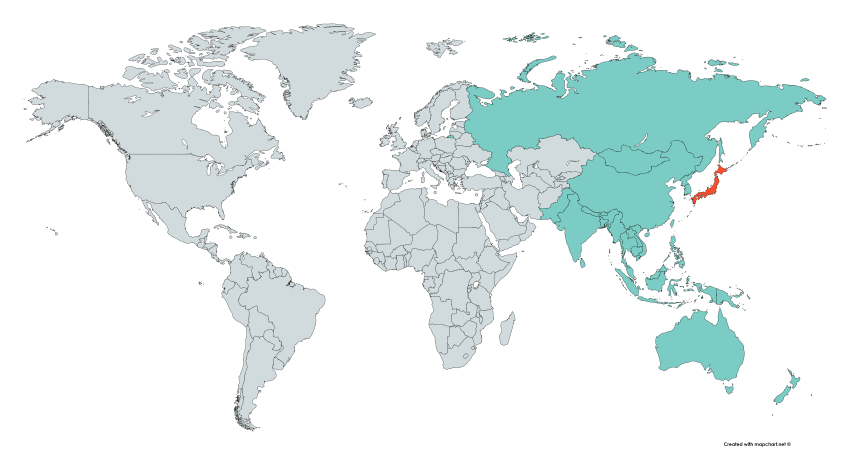

2016 Overview – APAC region excluding Japan (2)

China made up 70% of deal volume in the region, with their investment heavily directed towards Europe (US$88bn) and the US ($63bn).

Germany attracted 33 deals from China to become Europe’s most targeted country by deal volume and value, up by 32.5x from the previous year.

Technology-driven outbound M&A opportunities in the environmental sector remain attractive for Chinese companies, even as the broader outlook in China deteriorates due to the regulatory change to stem capital outflow.

Australia saw 486 registered deals totalling $65.1bn and comprising 9.9% value from the APAC (excl Japan) region.

Cross-border deals and the FMCG sector

There were 312 FMCG cross-border deals in 2016 worth a total of $57.5bn. Though a smaller year than 2015, there has been a steady deal flow, largely driven by demand for organic, local, additive and cruelty-free products particularly among millennials.

Large companies are using the acquisition of healthier and more prestige or boutique product ranges to create a halo effect driving up their reputation across their entire brand. (E.g. Dr Pepper Snapple buying Bai Brands, maker of coconut water and antioxidant-rich fruit drinks. + Danone buying WhiteWave Foods, a natural, health-focused beverage business.) (3)

Cross-border deals and the Defence and Technology sector

Increasingly we are finding international cross-border locations to be an opportunity rather than a barrier in the M&A process. Though communication and the negotiation and due diligence phase can be more challenging, the mutual opportunities that exist to connect the best strategic acquirer with your business far outweigh the downside.

Particularly in sectors such as defence where a product offering and customer base is not restricted or governed by location, often the best acquirer is overseas.

We recently brokered a deal for Micreo, a small to mid-sized electronic warfare engineering company based in Brisbane and acquired by global technology giant, L-3 Technologies.

L-3 Technologies, headquartered in New York City, employs approximately 38,000 people worldwide with 10.5bn in sales annually and is a leading provider of communication and electronic systems and products used on military, homeland security and commercial platforms.

The acquisition of a distant and much smaller business was an opportunity to strengthen their Australian footprint and expand the offering of their existing UK division L-3 TRL which specialises in Integrated Sensor Systems.

This is a clear example that small business size and distant geographic locations are no longer deterrents to large acquirers provided the right strategic opportunity exists.

Click here to read the case study on L-3 Technologies’ acquisition of Micreo.

Digital innovation driving deals

The drive for digital innovation is far reaching, affecting not only technology companies, but any business that can leverage digital innovation to gain a competitive advantage. Many non-technology companies are looking to M&A as a quicker and more viable way to access the revolutionary platforms, models and delivery systems they need to grow value and gain a competitive edge in their market. (4)

Key digital focus areas anticipated to drive M&A in 2017 are cyber-security, fintech, Internet of Things and e-commerce.

At the top end of town, this has been demonstrated through Unilever’s $1b acquisition of five-year-old start-up Dollar Shave Club, an online subscription service that delivers shaving products monthly.

Similarly we’ve seen Dominos dominate competitors in the Quick Service Restaurant sector over the past year, largely as a result of a progressive digital strategy that revolutionised the purchase process to address long-standing customer pain points.

Outlook for M&A deal-doing in 2017

Despite downturn in 2016, and although many of the challenges still remain, 2017 is anticipated to bring a bounce-back in global M&A activity. Dealmakers believe market activity will be increasingly driven by private equity buyout activity, the corporate drive to cut costs through efficiency, and buying activity from Asia-Pacific acquirers.

We are confident that Australia will reflect the global bounce back. We are seeing more genuine buyers in the market than at any time since before the GFC, in particular listed companies are now beginning to look seriously at growth through acquisition again. Giving money back to the shareholders via dividends isn’t producing the capital growth that ultimately shareholders really want, so putting money to work is the answer.

Reference:

(1) MergerMarket 2017 M&A Outlook, Donnelly Financial Solutions

(2) Asia Pacific M&A deals in 2016 – overview

(3) Baker McKenzie Report: Changing Consumer Demand drives FMCG M&A

(4) David Fleming, partner in Baker McKenzie’s Hong Kong practice.