- 04 May 2023

- Michael McGrath

How to fairly structure a deal

Lesson #7 in our series, How to Sell a Business, covers the critical matter of deal structure. Once a willing buyer and a willing seller agree that they wish to transact, how should the transaction be constructed?

Deal structure is all about risk. The buyer is assuming a degree of risk insofar as he wishes to buy the business and own its future cash flows. Certain representations will have been made by the vendor about the business’s performance. Based upon the buyer’s understanding of the business, they will generally make a non-binding indicative offer. At this point, the offer is normally subject to due diligence and contract.

The buyer will want to investigate the business and its performance in more detail. These investigations are often made during an agreed period of exclusivity, typically 12 weeks. The offer will normally have various terms, including price and when payment will be made.

Through these terms, the buyer is seeking to manage their risk. This might involve deferment of some of the consideration until certain matters are confirmed after completion. Often this might be the completion of a set of accounts, where a period of time is necessary to finalise them.

Other retention amounts might be required to provide security to the buyer where the warranties and undertakings made by the vendor are accurate. Even in a cash transaction, we typically see between 12-15% deferred for up to 12 months.

The vendor is seeking to minimise and mitigate as much as possible any deferment. What helps with this negotiation is the accuracy and reliability of financial information. Certainly, accurate and timely management accounts are important when seeking to build confidence with a buyer.

Buyers often require more significant deferment; these are frequently referred to as ‘earn-outs’.

Earn-out amounts might be as much as 25-50% of the total consideration, meaning large parts of the consideration will be paid one, two, or even three years after completion and only if certain milestones are achieved.

These kinds of structured deals are not popular with vendors or their representatives. However, many corporate acquirers insist on them, especially where there is uncertainty about future income and earnings.

Transactions provide opportunities to get creative and structured deals, in particular, enable a vendor to benefit from the future up-side of a merged business post-completion. After an initial de-risk (the sale of, say, 51%) the following one to three years can present an opportunity for both the buyer and the vendor to work together to create value that can provide greater future equity to the vendor.

How to tip the balance in a structured deal

About half the transactions we are involved in require some sort of structured deal outside of a simple deferment of 12-15% based upon a warranty deferment. This is often the period where the buyer is nervous about the sustainability of future revenue and earnings, while at the same time, the vendor is confident in the future of the business. The buyer, in effect, says, “I don’t believe your projections,” and the vendor says, “OK, so confident am I that I am open to being paid when we deliver them.” This divergence of views allows for the deal to be structured.

A structured deal facilitates bridging the gap between what the buyer says the business is worth at completion versus what the vendor thinks it’s worth at completion. The potential for the vendor in this scenario is to turn the tables on the buyer. If the business is worth $X to the buyer at completion and the vendor wants $Y, (always more than X!) then the vendor can often secure $Y plus a premium above $Y by agreeing to a deferment. The premium can come as and when the vendor beats the milestones.

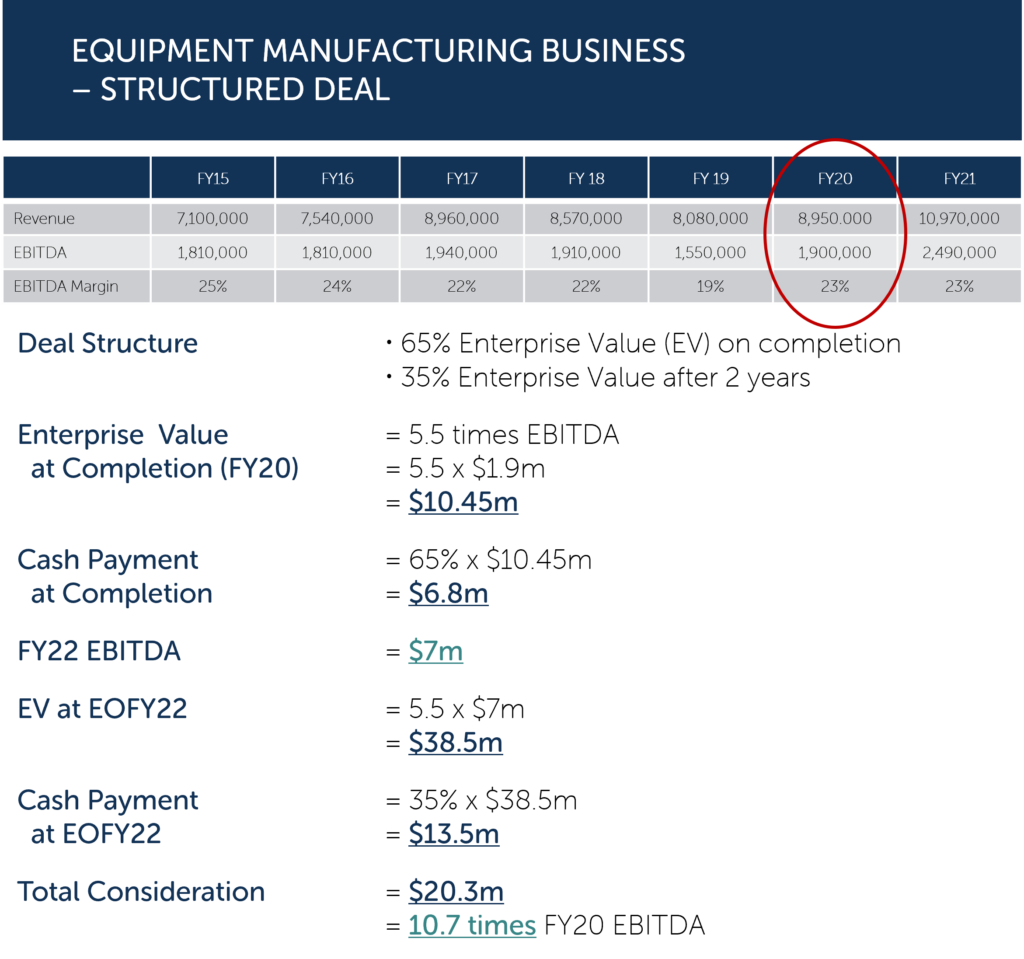

The details and variations involved in these kinds of structured deals are many and varied, and covering them adequately is beyond the scope of this short blog. However, below is an actual example of a recent transaction we presided over, representing the vendors.

Recent structured deal that delivered a premium to the vendors

An international private company based in Europe was qualified by Oasis, and terms were agreed upon. The buyer sought to acquire 65% of the business at completion and it was agreed that the remaining 35% would be purchased, based upon an agreed formula, on the second anniversary of the initial purchase date.

The vendors were confident in their story and their prospects and felt that the merger would deliver some future upside due to the buyer’s international reach. The deal was completed, and the average earnings in the two years following completion went from $1.9M EBITDA (earnings before interest, taxes, depreciation, and amortisation) to $7.0M EBITDA. This resulted in the vendors securing more for the second trench (35%) than they received for the initial 65%. The effective valuation multiple doubled.

The Future

The vendor was delighted, but so was the buyer, who, even after paying more, secured a much more valuable asset. At the same time, they de-risked the acquisition through both the deferment and the continued goodwill of the owners throughout the two-year earn-out period.

We see much more of this kind of structured deal happening in the future, especially as interest rates rise and economic uncertainty continues. It can be an effective way to bridge the widening gap between what a buyer will pay initially and how vendors value their businesses. It may mean contemplating an exit sooner than the vendors might have thought, given their likely post-completion involvement. An exit is more of a process than an event, and we believe it pays to consult early.

For more information and clarity on deal structure and how to optimise an exit, contact me or one of my partner colleagues anytime.

To read Lesson #6 in this series, click here