- 22 November 2022

- Michael McGrath

Lesson #5: Does the Size of my Business Matter to Buyers?

Following on from “How to go about Finding the Right Buyer for my Business” we turn to the subject of size!

Does it matter?

Size is one part of a buyer’s criteria; the short answer is that it depends on what they are looking for. Some trade buyers and most private equity (PE) buyers will have a strict criterion which often includes a minimum gross revenue or more often a minimum earnings requirement (normally EBITDA).

However, we are increasingly finding that buyers are dispensing with or are flexible around size especially where the other aspects of their given criteria are being met through a potential target business. The closer the features of the target business match the buyers’ criteria, the more likely they are to look past any revenue or earnings threshold. PE buyers will often hold fast to their minimum earnings criteria where they are not yet invested in the sector in question. However, if they have already invested, through what is often described as a “Platform Investment” then they will often dispense with size, preferring a good overall fit. This target becomes for them a “bolt-on” where there may be synergies (both costs and marketing). The private equity buyer, once invested in a sector is often under some pressure to expand quickly. Remember a PE firm is getting in on the second floor (not a start-up but a well-established business) and is normally seeking an exit on the 3rd or the 4th floor, 3-5 years later. Acquisitions are therefore a great way for them to secure scale quickly in preparation for their exit.

Trade buyers are normally much more interested in the overall fit and less fussy about size, especially within Australia. Overseas buyers can often lay down a minimum size however not always! One of my colleagues recently agreed terms with a large US company, the client has recurring revenue of just under $2.0M and the “fit” with the buyer’s business was very good.

Market Dynamics

The specific market dynamics in the sector can also be a factor in determining whether the size of a business is of significance. For example, the IT Managed Service Sector (MSPs) in Australia indicates strong interest from buyers to the point where size is becoming of little consequence. Why? Because MSPs are struggling to secure organic growth (growth through adding new businesses through traditional sales and marketing) therefore those companies committed to expanding are busy seeking “bolt-on” acquisitions. This sector is now showing strong features of being a seller’s market. Buyers are interested in the target’s clients and the ease to which they could be integrated

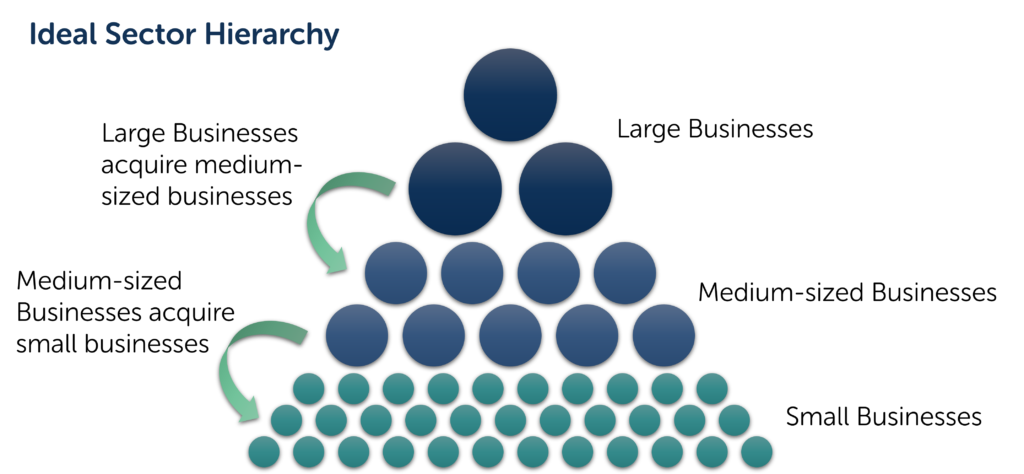

The optimal market dynamic is that there are plenty of large acquirers and a good number of mid-sized businesses and then plenty of small businesses. Basically, the big guys buy the middle guys, and the middle guys buy the little guys, and everyone is happy. Unfortunately, not all sectors display these features.

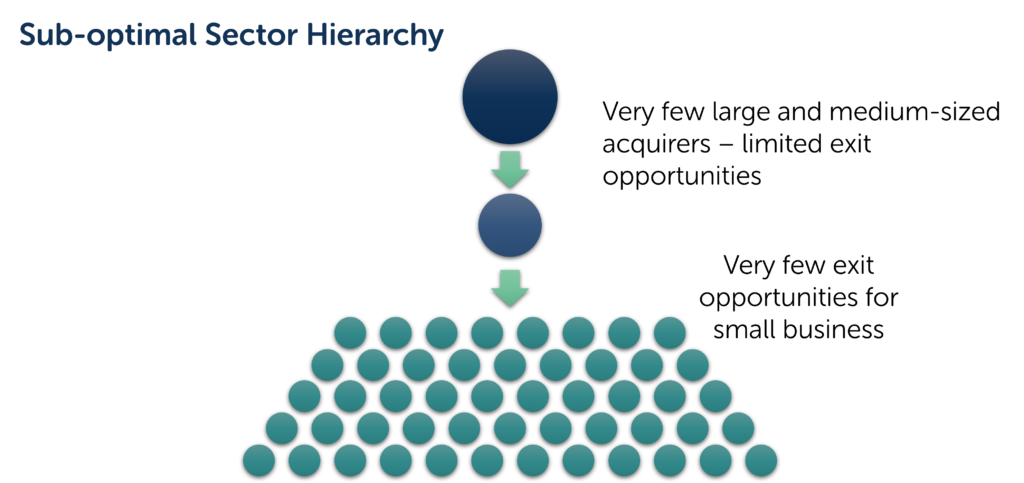

Some industries have very few large buyers or only mid-sized buyers, while other sectors have few large or mid-sized buyers. A sector with mostly small businesses, we call a cottage industry. The prospect for a successful exit diminishes in these circumstances and sellers must resort to allied verticals seeking larger buyers from adjacent markets. These dynamics affect the criteria especially around size. With few or no larger buyers in an area then anything too large is a problem.

The good news is that it’s possible to figure out the dynamics in a sector or in the adjacent allied sectors before starting work. These specifics can then be factored into any exit strategy. On the plus side, a smaller business means that the potential corporate market for an opportunity expands. Many trade buyers at the upper-small or lower-medium size can afford to look at a smaller acquisition.

We see significant opportunities emerging in many sectors for well organised, small to medium sized trade buyers who know what they are doing, as the retirement demographics continue to feature in Australia and the baby boomers seek to exit and retire. Vendors will need to intelligently access this emerging market of new trade buyers without it becoming widely known that they are potentially for sale.

If you need advice call me or one of my partners today.

Good Luck and Stay Safe.

Read Lesson #4 HERE