- 21 September 2022

- Michael McGrath

How to Sell a Business: Lesson #3:

We established in Lesson #2 that if a business is approached by a potential buyer (Gorilla) that the interest must be qualified and handled efficiently leading to an early indicative offer in writing, based upon the provision of adequate but limited information. We also determined that such a buyer, having knocked on your door, is likely to have knocked on quite a few other doors and is probably running a broader process.

If you decide that you don’t like the odds of waiting for the knock on the door or that having had an approach you don’t think the acquirer is the most strategic, then you can run your own process.

Running Your Own Process

We are told by owners that the biggest single issue when contemplating the sale of their business is the concern that it becomes widely known that they are for sale. This is a legitimate concern. Value can quickly erode if suppliers, customers, and staff become aware that the business is for sale.

So how do you get to the widest possible market for your business without having it become common knowledge that you are for sale?

- Don’t rely on confidentiality agreements (although you should always get them signed). Unfortunately, many buyers do not adhere to their obligations under such agreements, and it is notoriously difficult, if not impossible, to get legal redress. In any case the damage is often done.

- Don’t waste your time writing an Information Memorandum (IM). The IM quickly becomes out of date. It is considered by most professional buyers as a brochure that accentuates the positive at the expense of the truth. Many of the professional buyers we speak with are too busy to wade through 70 pages of blurb and are unlikely to get past the executive summary at the beginning. So why trade all that sensitive information for a Confidentiality document that could be breached with no effective redress?

- Our view is that you figure out who is likely to have a horizontal or vertical gain through the ownership of your company and then qualify them – without detailing that you are for sale.

- Qualification is about the potential acquirer and their intentions with respect to future acquisitions. It’s vital to avoid what we call “premature pitching”.

- The most intelligent question you can ask a potential buyer is, “what information do you need to go to the next stage?” Information should be earned by a buyer. Deals are done in stages. Keep in mind what stage in the process you are at and make sure the information request is reasonable and appropriate.

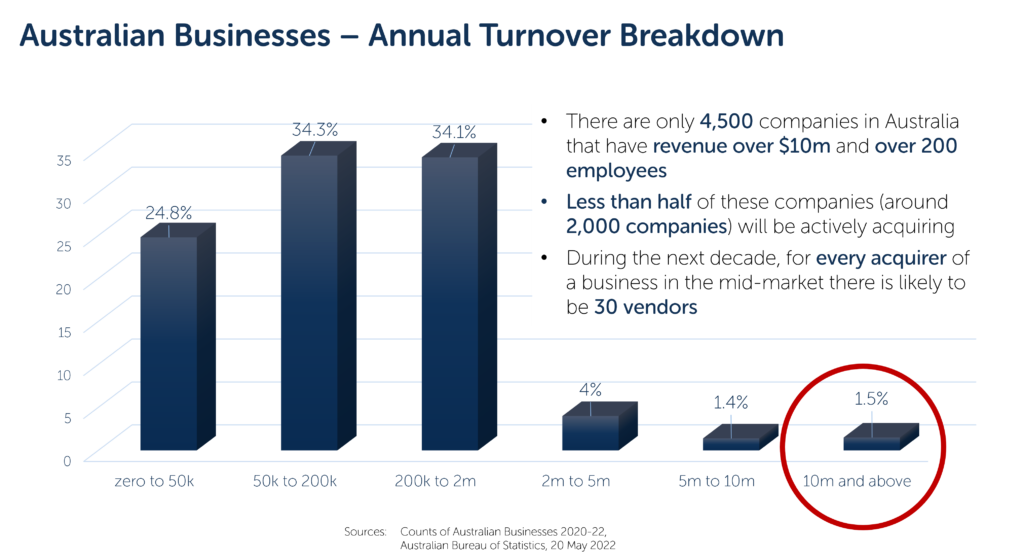

How big is the Market for My Business?

The macro picture suggests that there are perhaps 2,000 buyers in Australia based upon an extrapolation of the size of companies. This excludes overseas buyers – about half of our deals in the last decade have had an overseas element to them. Interestingly we estimate that there is likely to be many more vendors coming to the market in the next 15 years than there are buyers to acquire them. We think that there are currently 15,000 aged-related sellers (in the mid-market, staff numbers 5-199) coming to the market annually.

Different sectors present a different picture in terms of number of buyers and appetite for certain requirements. The dynamics in each sector is beyond the scope of this short blog. However, if you would like a snapshot of what we are currently seeing in your sector speak to me or one of my Partners.

A market, with many more sellers than buyers, demands an intelligent and strategic response from vendors when seeking an orderly and successful exit. More on this in a future lesson.

What is Qualification?

It’s simply the independent establishment of a buyer’s acquisition criteria before the release of the identity of the business. Professional corporate business buyers do not purchase outside of their pre-determined criteria and are unlikely to be talked into something that does not match that. However, buyers will look if you offer something, and they will receive IM’s as they are paid to be in the know. This exercise is a waste of time and energy and puts the business at risk of having it leaked to the market that its “for sale.”

Lesson #3. Qualify buyers, limit information release to a minimum (prior to an indicative and non-binding offer), and when running a process avoid the release of your identity until qualification has been completed.

Stay safe and good luck!