- 24th August 2021

- Michael McGrath

Many of you know that I am on the board of several private companies, five of which are manufacturers. We love manufacturing here at Oasis Partners. We love helping manufacturers grow and we love transacting in the manufacturing space – we have acted for many owners in manufacturing. Manufacturing is also doing much better in Australia than it’s often given credit for – it employs over 800,000 people in Australia.

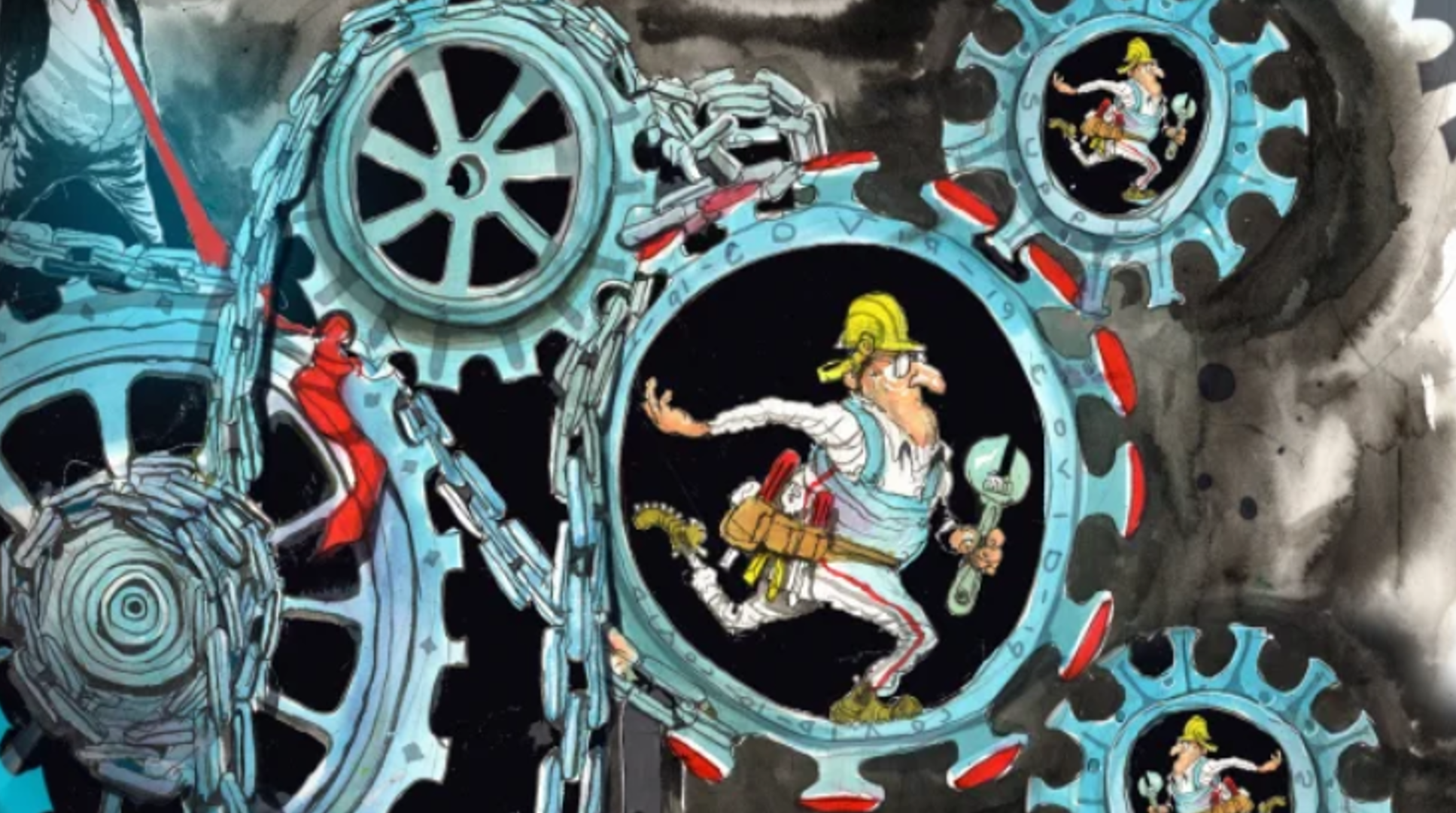

I have been saying for quite a while – based upon my experience – that the challenge in manufacturing is on the supply side, not the demand side. This challenge emerged in Q4 of FY20, due to early effects of Covid, and has continued to get worse. It’s much more than challenges with shipping and logistics – although that has been and continues to be a significant disrupter. It’s down to serious shortages in raw materials and componentry as different parts of the world come out of lockdown at different rates and commodity pricing continues to rise and filter through to products.

Jim Clayton, the CEO of Breville, puts it well: “we now find ourselves in a global drag race between the race between vaccinations and the Delta variant”. We are seeing this first-hand in Australia right now.

The challenge is very well-articulated by Jim in the article [1] penned by James Thomson in the AFR on 17th August. What is not mentioned is the significant raw material price increases we are seeing driven by supply and demand issues. Terry Smart, the incoming CEO of JB Hi-Fi, mentioned supply chain disruption in his discussion reported also by James Thomson the AFR. Smart thinks the issue will play out over the next six to twelve months – citing computer chip shortages which are a huge issue for so many manufactured products.

We are seeing significant upward price shifts in nylon to name but one among several, which is causing huge challenges in the wiring and electrical market. Product price rises are coming – it’s the giant elephant in the room and some buyers are avoiding it and pretending it’s not there – but it’s coming, although it takes time to really filter through. To what extent price rises drives inflation is way above my pay grade, but we do expect to see some impact – to what extent that will soften demand is also a huge unanswered question. So far, the economy in Australia has been very resilient and the bounce-back after each lock-down has been terrific. However, consumer confidence is a fickle thing and while sentiment changes imperceptibly at first, it does change and it can hurt business when it goes lower.

To end on some good news, Australia is currently vaccinating at unprecedented levels and Covidlive.com is reporting that if we can keep the rolling 7-day-average vaccination rate up, we will see 70% vaccination across Australia by 1st November. This will give us a basis to move around and enjoy some much needed out and about time and will certainly give a boost to an economy which in some sectors has been shut!

Stay safe

Michael McGrath

CEO

[1] Breville’s supply chain pain is a warning for the economy, James Thomson, 17th August 2021