- 17 August 2016

- Michael McGrath

Acquiring a business is often considered the preserve of large corporate entities and often this is the case; we spend much of our time intelligently presenting our client’s businesses to large Australian and international corporate acquirers.

However, we are seeing increasing opportunities for well run and managed small to medium enterprises (SME’s) to acquire businesses which can greatly strengthen and enhance their offering.

The driver for an acquisition is often that a large entity wishes to expand its capabilities (products or services) and/or its geographical presence and has figured out that it’s likely to be cheaper, in the long run, to buy rather than build.

Irrespective of their often considerable resources, history has taught large enterprises that they are usually not good at starting things from scratch and they often lack the innovative, passion and entrepreneurial flair that allows a new business or service to prosper and thrive.

In fact, large companies are bad at innovation by design. As outlined by Maxwell Wessel in his article ‘Why Big Companies Can’t Innovate’ (1) , “In its infancy, a company is designed to bring innovation to the market. A start-up’s success is not gauged by earnings; it’s measured by how well it identifies a problem in the market and matches it to a solution… Within a mature organisation, the measure of success is very different: it’s profit…. Organisational structures and processes emerge to guide the company towards efficient operation. Seasoned managers steer their employees from pursuing the art of discovery and towards engaging in the science of delivery.” This is why many successful mergers and acquisitions come from marrying the innovation of start-ups with the capital and distribution channels of larger enterprises.

Typically, a smart acquirer will save both time and money by making the right acquisition. Provided it’s done correctly we think the same opportunities are also available to small to medium sized enterprise.

Certainly there is a need to ensure targets are proportionate to the acquiring party’s scale. However, the same proportionate benefits are available to SME’s even if there are less zeros attached the price tag.

We estimate that 350 medium sized companies were sold in Australia in 2015 and for every completed deal there were 14 other businesses for sale which were unable to find a buyer. These odds are long and confirm the current statistical reality that there are many more business sellers than business buyers.

That fact is unlikely to change over the next decade ; we are at the beginning of a huge shift in business wealth as more than 1.4 million baby boomers who own businesses, employing 7.9 million people and contributing $500B in GDP look to retire by 2024 (2). Fewer than 25% of business owners have any plan to hand the business down to the children (3) and management are often incapable or unable / unwilling to take over the business.

Therein lies the significant opportunity for ambitious, well run small and medium businesses to intelligently evaluate their sector for an opportunity to expand by acquisition.

Now this is not a get-rich-quick scheme and typically we don’t see too many people do this well – even large corporate acquirers. Nevertheless, there are genuine opportunities to create value through acquisition whilst managing the down-side risks.

To read more about ensuring acquisition is successful for your business, see our checklist.

Once an SME has identified acquisition as the best method to expand, the next question is typically “How would we fund it?”

How can an SME fund acquisition?

Since the GFC lenders “have become more risk averse, impacting negatively on the availability of credit for SMEs.” (4) With the proportion of annual bank loan write-offs from SME loans doubling (though only from 0.5% to 1%) since pre-GFC compared with losses in housing loans remaining stable (5), it’s no surprise that the banks in Australia are 80% geared toward mortgage debt and mostly domestic dwellings. They understand property – it’s low risk (so far anyway).

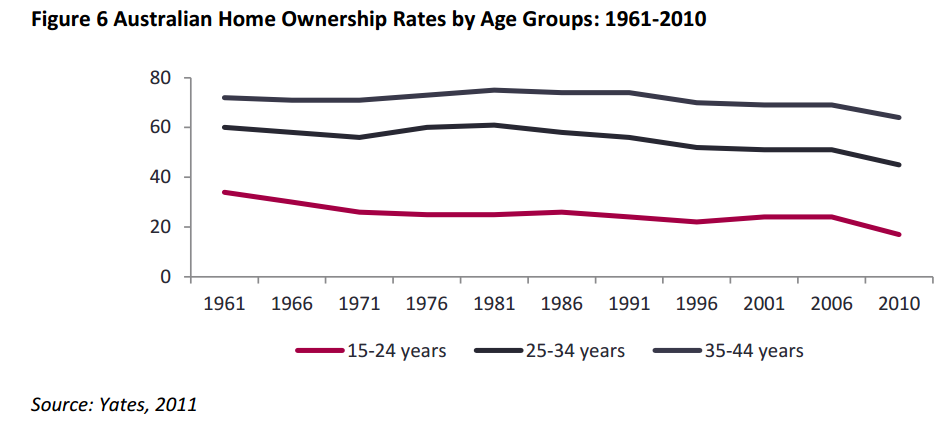

Historically banks have done most of their business lending to the SME sector on the back of property and often the personal property of the business owners. However, increasingly the banks are waking up to the generational shift taking place and the huge numbers of gen X and Y who don’t yet own property – or if they do they have low levels of equity with which they can borrow against. (See Table 1)

They are also aware that the baby boomers, even the fit and healthy ones can’t live forever, so they need to adapt.

Table 1: Australian Home Ownership Rates by Age Groups: 1961-2010

The answer, according the banks themselves, is increasing openness to cash flow lending! They are now openly acknowledging that a well-run enterprise has value beyond the personal property assets of the owners or the conservative break-up value of the enterprise and that if they don’t start to get more creative they will run out of people with property who they can lend money to. Interestingly, the banks have been lending like this to their large corporate customers to help them make acquisitions for years.

“Though NAB’s lending to retail SME customers barely moved from June 2015 to June 2016 (from $16.26B to $16.27B), NAB’s chief executive Andrew Thorburn is shaking up the management ranks to ‘focus on our priority SME customers’ moving forward with the new division called Business and Private Banking launched last month.

Westpac’s lending to SMEs in the same period shot up 53% to $12B. David Lindberg, chief executive of Westpac’s business bank, told the St George Foundation dinner last week that SME business lending at Westpac is growing at the fastest rate in a decade. It is growing four times faster than big ticket corporate lending.” (6)

Now before you start rushing out to your local branch to tap up the ‘business banker’ for a cash flow lend to buy out your local competitor, there are some rules to the game which I’ll spell out in another blog.

A quick heads-up, the local business guy at branch level won’t have a clue what you’re on about and is unlikely to even acknowledge the possibility of cash flow lending without the security of bricks and mortar. Trust me though, it’s going on as we speak, however it does require a reasonably sophisticated approach and some time. Warning: you are unlikely to get anywhere if you appear in any kind of rush!

The relationship with a financial institution is like many other relationships, it takes a little work and effort. The institution needs to be clear on your strategy and plans. They will also be keen to know that you have set a criteria for what the right kind of business will look like and how you intend to value it. They will want to know how many others you have looked at and why you feel it is worth whatever enterprise value you are placing on it. Critically, they will need to be clear on the synergistic effect of the new entity on your business and exactly how 1 plus 1 will equal more than 2!

One final point: a business is worth whatever you, the potential buyer, say it’s worth at that point in time. Valuing an organic asset such as an SME is not simple. It can and often will be legitimately worth significantly different amounts to different strategic buyers depending on the value to them. Of course the buyer can also decline your offer which is why it pays for you to run a thorough campaign, looking at multiple opportunities simultaneously understanding that there are many more sellers than buyers.

How to go about securing a deal

Once you’ve decided that acquisition is the best way to secure the growth you’re after, involve your corporate advisory or M&A firm to work out your game plan.

This will include

- Defining criteria for your acquisition target

- Defining a target list of businesses to acquire

- A valuation strategy

- A plan for how to finance the deal

- An integration plan to ensure a successful future for the newly merged businesses

Image credit: Ryan Hyde, ‘Bigger’

(1) Harvard Business Review – ‘Why Big Companies Can’t Innovate’ , Maxwell Wessel

(2) PwC – ‘Poor Transition by Million Plus Retiring Business Owners to Hit Hard‘, 25 Feb 2014

(3) Smart Business Exit – ‘There’s an Elephant in the Room‘ 18 February 2016

(4,5) Australian Centre for Financial Studies – ‘Lending to Small & Medium Enterprises‘

(6) Financial Review – ‘NAB Quarterly Shows Woeful Small Business Lending Performance‘, 15 August 2016